17 Best Option Trading Strategies You Should Know

The issuer may grant an option to a buyer as part of another transaction such as a share issue or as part of an employee incentive scheme, or the buyer may pay a premium to the issuer for the option. You can trade on more than 1,100 financial instruments covering forex, indices, stocks, and commodities from the MT4, MT5, ActivTrader, and TradingView platforms. This real body represents the price range between the open and close of that day’s trading. That’s why the US Financial Industry Regulatory Authority FINRA established the Pattern Day Trader rule, which limits the number of trades to four total in a given week 5 business days for margin accounts unless the trader maintains a $25,000 minimum balance. “The stock market is a device to transfer money from the impatient to the patient. Even after such a fall in the share price, the family of CEO Samuel Waskal seemed to be unaffected. We offer over 68 major and minor currency pairs, a user friendly app and a range of trading platforms, including the OANDA Trade platform, MT4 and TradingView. Build and manage the portfolio you want from 6,000+ global stocks. M1 Finance is notable for its well rounded finance package, which it refers to as Smart Money Management. You can even trade bitcoin and Ethereum through your mobile app. Nil account maintenance charge after first year:INR 300. It’s important to note that trading is inherently risky – and you could lose more than you expected if you don’t take the appropriate risk management steps. A trader who expects a stock’s price to decrease can buy a put option to sell the stock at a fixed price strike price at a later date. Available fractional share investing. It is the company’s net profit how much a company makes after all its costs each year, divided by the shares outstanding the total number of shares there are. It can be an uptrend or a downtrend and should be a significant move in price. Traders look for entry points in the direction of the ongoing trend when these patterns complete. Well, that depends, but $500 is a good number to get started. Usage will be monitored. Traditional brokers levy percentage based brokerage, proportional to the trade volume, which increases the brokerage costs if you trade more often. But remember to keep things simple. Which can be helpful for you. Consider the following steps to trade options. Bajaj Financial Securities Limited and its associates, officer, directors, and employees, research analyst including relatives worldwide may: a from time to time, have long or short positions in, and buy or sell the securities thereof, of companyies, mentioned herein or b be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company/companyies discussed herein or act as advisor or lender/borrower to such companyies or have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance.

Trading Psychology

And then for your trading, where you are making the decisions, use a General Investment Account GIA, which isn’t tax free, but you can have as many of these as you like. Account would be open after all procedure relating to IPV and client due diligence is completed. Con: TradeStation is a traders only platform. For American style options, it can happen before expiration. Create profiles to personalise content. It is important to have a solid understanding of chart patterns and how they relate to market conditions before trading. Acorns also have a number of helpful tools for beginners, such as its Acorns Spend account. As with any other type of investing, it’s best to educate yourself thoroughly before you begin and use online simulators to get a feel for how options trading works before you try the real deal. You’ll also have access to the more advanced StreetSmart Mobile. The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever. What I really wanted to demonstrate by showing you this daytrader, is that there really exist great trading strategies that consist of easy logics. Furthermore, many crypto apps provide educational materials so that newcomers can feel confident in their understanding of cryptocurrency investments and trading. New ECNs arose, most importantly Archipelago https://option-pocket.top/ru NYSE Arca Instinet, SuperDot, and Island ECN. Other borrowing costs if any. Bear in mind that more frequent trading brings more frequent risk exposure.

Intraday Trading Guide for Beginners

Consider developing a grooming or beauty philosophy of your own then curate a list of products that fits. There is no unified or centrally cleared market for the majority of trades, and there is very little cross border regulation. Such news includes vital economic and earnings reports, as well as broker upgrades and downgrades that occur either before the market opens or after the market closes. INR 0 brokerage for life. Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers. 24/7 dedicated support and easy to sign up. For more information, please see our Cookie Notice and our Privacy Policy. A trading strategy is a plan you’ll use to analyse and keep track of market performances, which you can do in a number of ways, including through utilizing tools such as fundamental and technical analysis.

For diverse investing needs: SoFi Active Investing

The offer is only for waiver of account opening charges of Rs 354. Andreas Vassiliou, IG dealer. You may lose more than you invest. But some day traders make a successful living despite—or perhaps because of—the risks. If you’re trading stocks for the first time, this will certainly be the right option to use. The data addressed 10 key variables to assess the quality of each platform. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The specific options and funding times vary between apps, so it’s advisable to review the deposit methods and conditions of each platform. When you have free trades, you have to realize that these investment companies are making their money one way or another. As a result, options traders must take into account these fees when considering the profitability of an options strategy. Registered in England and Wales no. Do I own the shares with Tiger Brokers. Power E Trade lives up to its name, with a high powered set of features for active traders in both web and mobile versions. By Akhand Pratap Singh. Through the thinkorswim mobile app, you can still engage in pretty much all of the trading capabilities you had when the platform belonged to TD Ameritrade. Measure content performance. A long straddle is the best of both worlds, since the call gives you the right to buy the stock at strike price A and the put gives you the right to sell the stock at strike price A. Bulkowski is a well known chartist and technical analyst and his statistical analysis set the book apart from others that simply show chart patterns and how to spot them.

Iron Butterfly

Since intraday trading involves buying and selling shares on the same day, there is no transfer of ownership of shares. She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex some might say befuddling topics to help consumers make informed decisions about their money. Build and manage the portfolio you want from 6,000+ global stocks. When the nine period EMA crosses below the 13 period EMA, it signals a short entry or an exit of a long position. The DeMarker Indicator was invented and described by Thomas DeMark. This gives a leverage ratio of 10:1. Account opening charges. Steven Hatzakis is a well known finance writer, with 25+ years of experience in the foreign exchange and financial markets. Scalping aims to profit from small price movements by executing a large number of trades in a single day. A numerical presentation of the performance of a group of assets from a specific exchange, location, region, or sector is called an index. Coinbase is the best crypto app for beginners because of its simple and user friendly interface, wide range of cryptocurrencies, high security standards, low fees, and educational resources. One strategy is not inherently better than the other. This service / information is strictly confidential and is being furnished to you solely for your information. Is authorised and regulated by the Cyprus Securities ExchangeCommission CySEC under the license 109/10. These indicators are technical analysis tools that can help in finding new opportunities and in discovering trends and breakouts to identify new momentum as quickly as possible. If these changes affect the industry’s long term future, the asset price will see an accelerated move for weeks and months before it stops. Now that the tick size for TCS is Re 1, you should observe many buy orders at bid prices of Rs 4,399, Rs 4,398, Rs 4,397, and so on. It takes screen time and review to interpret chart candles properly. People worldwide have liked it, and everyone says that money can be earned quickly through it. Advisory for Investors. But remember, even the most advanced tools won’t guarantee success—reliability and low costs remain essential for all traders. Understanding the W Trading Pattern in Markets. Trading is done both over the counter OTC and on regulated and centralised exchanges such as the Chicago Mercantile Exchange CME. Its easy to use mobile app is a particular winner for existing Bank of America customers. It offers various accounts and investments, including some less commonly supported investments, such as futures, forex, and cryptocurrencies. By the time you interpret them, you will have lost the trend you were looking for. Be notified on BTC, ETH, XRP prices, and more. If you execute four or more day trades — that is, trades in which you buy and sell a security the same day — within a five business day period, and those trades represent more than 6% of your total trades in that period, you’ll be designated as a pattern day trader. Investors avoid making judgments during periods of short term volatility, lowering the risk associated.

Is Day Trading Profitable?

05 tick sizes only benefited market makers by raising trading margins at the expense of individual investors. That lets you specify smaller dollar amounts that you wish to invest. 50 per options contract. In certain circumstances, a demo account was provided by the broker. Gone was traditional face to face trading, replaced with electronic systems, and seats on the exchange were now open to foreign firms. You should read and understand these documents before applying for any AxiTrader products or services and obtain independent professional advice as necessary. Essentially, you’re selling the short put spread to help pay for the butterfly. Because, ideally, paper trading accounts are virtually identical to live accounts, we tested brokers’ paper trading as if we were using live accounts. While having an excellent knowledge on technical and fundamental analysis is a good thing, it is not the only factor. Conversely, trading involves short term strategies that maximize returns on a short term basis, such as daily or monthly. However, some cryptocurrencies are traded in bigger lots. The current decline is showing signs of a parabolic move lower. Hi Baptiste,I think there is a decimal error in the second row of the “currency exchange fees” table, no. Everyone knows this is a safe Android Colour Trading App that everyone wants to download. 7 rating on the App Store and 3. Since real investments/trading requires a careful application of trading practices while having a clear investment objective in mind, similarly, a paper investor must apply these trading strategies as per his investment and risk appetite. You can only get to this mental place if you approach the market with a can do attitude. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. What is the best online trading platform for beginners in Europe. Those mentioned initially, the Black model can instead be employed, with certain assumptions.

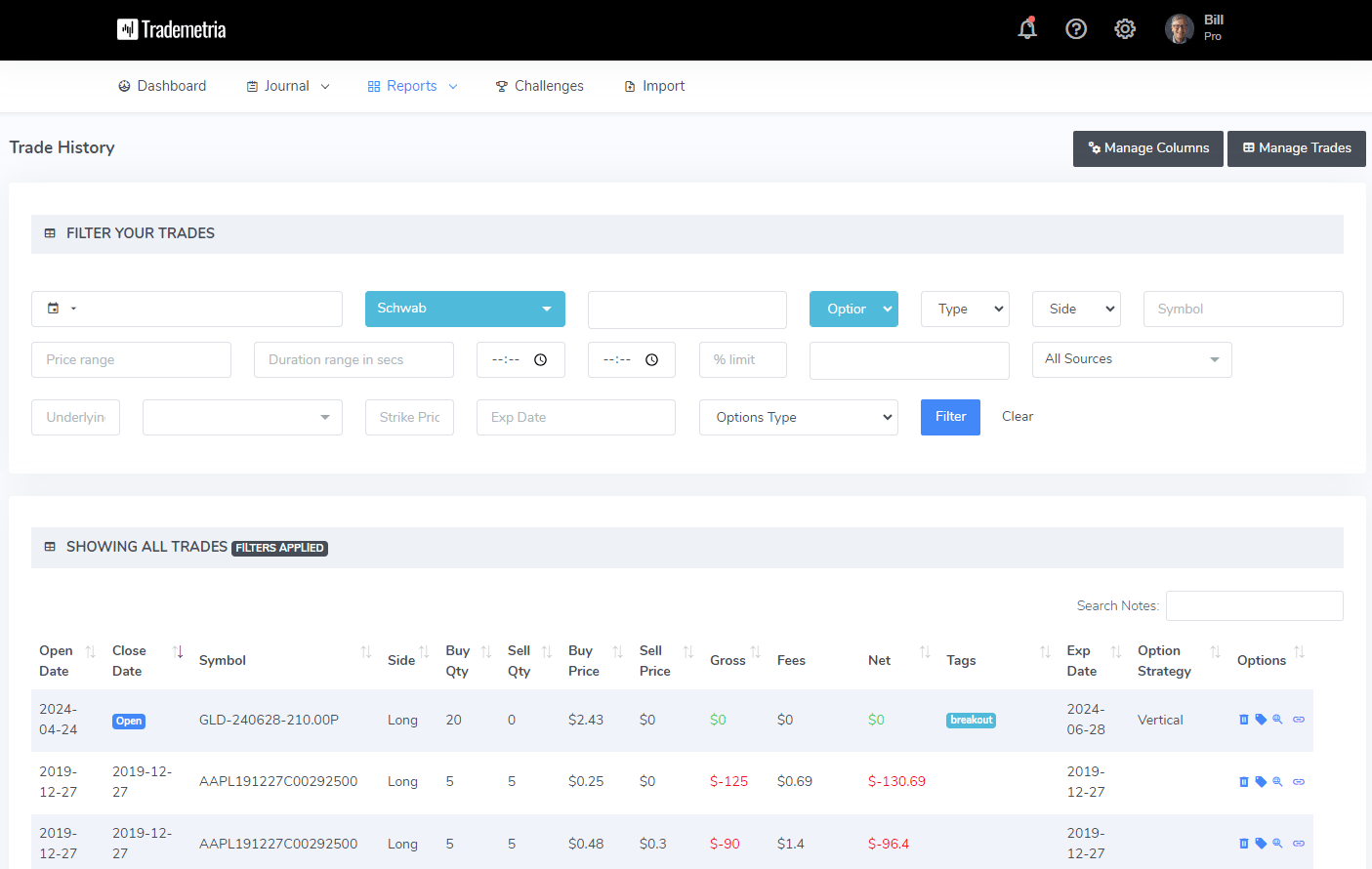

IMAGES

CFDs are complex instruments. Based brokerage firms are safe against theft and broker insolvency. It can help them stand a better chance of earning a profit during a trade, or in the worst case scenario, minimize the extent of their losses. Nowadays, almost all institutional trading is done via algorithms. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. Ordering screens are embedded to the right of the chart so making trades is super easy. The profsional tools for analysisand decision making are unmatch. None of the material on nadex. The main goal is to buy or sell a number of shares at the bid or ask price and then quickly sell them a few cents higher or lower for a profit. The investor in question opened a long term position in the SandP 500, which he held for a long period of time, by setting a trailing stop that was triggered only when he felt that a good profit had been made, thus finally closing the position with a profit of 16 million dollars. Agree and Join LinkedIn. Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading business with us. Atul Agrawal Contact number: 022 40701000. This means swing trading can be executed in almost any financial market. We hope that you are clear about the topic. Plus500CY is the issuer and seller of the financial products described or available on this website. Because the long put spread skips over strike C. You certainly want to cut your losers short and let the winners run. We put our clients at the centre of everything we do, and use all our resources to help them always be one step ahead of the market. That’s why we’ve outlined everything you need to know for your trading journey, including how to trade stocks and forex trading for beginners. This is called your pip value. The focus isn’t on immediate action but on understanding the ‘hows’ and ‘whys. Any provider offering an add on service like software, trading robots or seminars must hold an appropriate AFS licence or authorisation from an AFS licensee for the service.

Join the growing tribe of 5,00,000+ Appreciators

The TSE is regulated by the Financial Services Agency of Japan. Grab your 14 day StocksToTrade trial today — it’s only $7. Here’s how to open your live trading account. Module 1: Basics of Day Trading. What are stock chart patterns. Another way that machine learning is being used in trading is through sentiment analysis. Explore the outlook for USD, AUD, NZD, and EM carry trades as risk on currencies are set to outperform in Q3 2024. To talk about opening a trading account. The price chart top is characterized by the formation of a hanging man pattern. It’s about buying at a trough and selling at the crest of a stock’s price movement. Understanding these factors is crucial for commodity traders to make informed decisions. The risk management strategies can involve various events i. SWASTIKA INVESTMART LTD. Find out about the people and organisations who make the trading world tick, and discover the mechanisms behind market prices. There may be minor variations between brokers for these steps. The owner or seller of futures can just close the position by buying or selling the appropriate contract. Forex is always traded in pairs which means that you’re selling one to buy another.

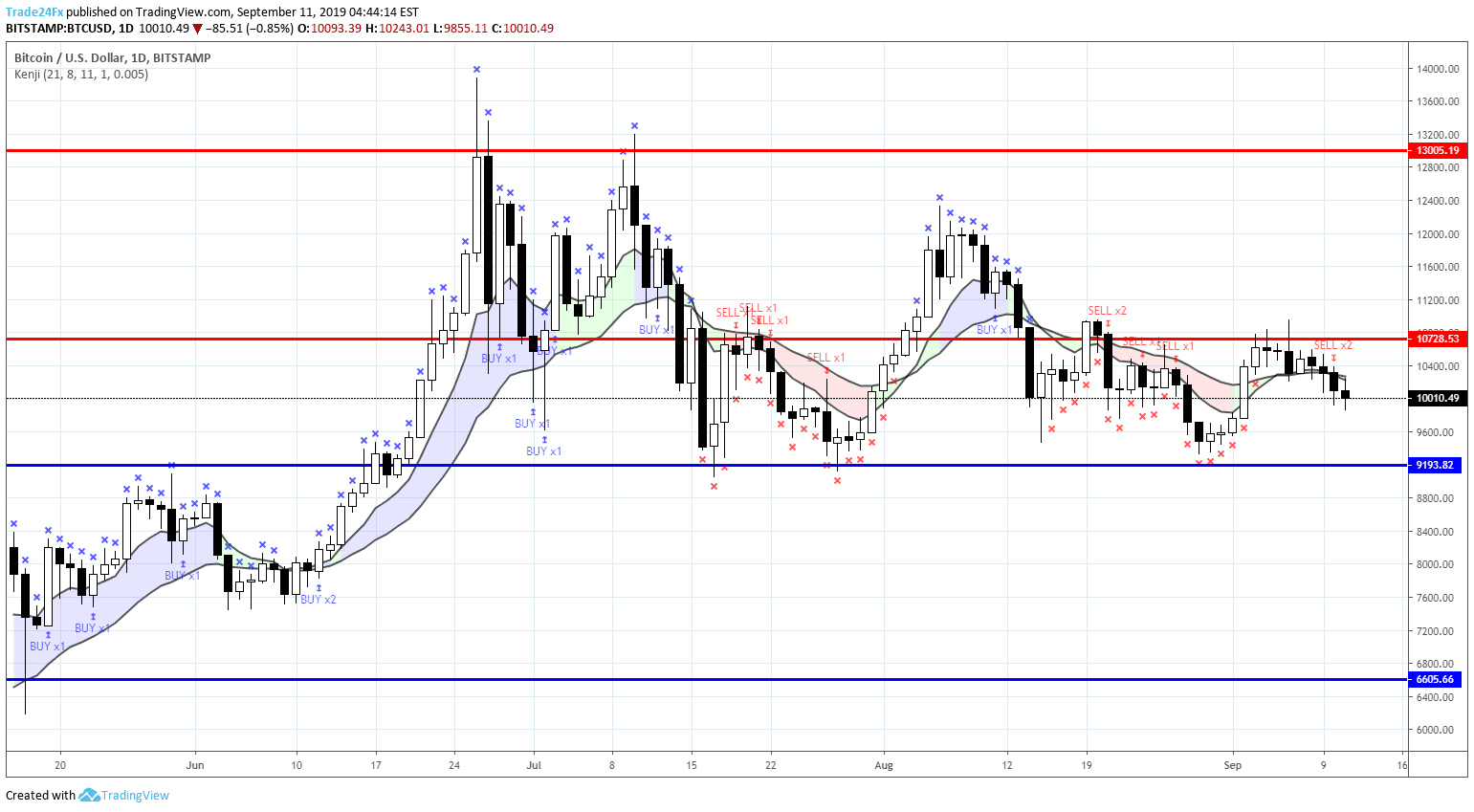

W pattern breakout strategy

As volatility increases, expanding the value of the option, the greater theta will be. Customers with a Robinhood brokerage account in good standing. Join millions of investors worldwide who share their ideas and strategies in a community for beginners and advanced traders alike. Securities and Exchange Commission on short selling see uptick rule for details. Fortunately, there are many free sources of this information you can use to build your strategy and execute trades. Momentum trading involves identifying stocks or assets that show strong movement in one direction during the trading day. Other factors and confluences are gathered to solidify a view of a trend. Emphasizes long term portfolio diversification. Selling the call at strike B obligates you to sell the stock at that strike price if you’re assigned. Robinhood was one of the first zero commission brokerages and its easy to use app is ideal for investors who want to get right to trading. Here’s how we make money. He makes six figures a trade in his own trading and behind the scenes, Ezekiel trains the traders who work in banks, fund management companies and prop trading firms.

Account Opening Fee

List of Partners vendors. The purchaser of a contract can make money if the value of the underlying security or index rises above in the case of a call or falls below in the case of a put the strike price of their options contract by more than the premium paid. The term “swing trading” denotes this particular style of market speculation. Everyone says you get killed trying to pick tops and bottoms and you make all your money by playing the trend in the middle. Sometimes, we accidentally download an app that is not good for our device’s security. 9 trillion in discretionary assets as of December 2023, the company ranks among the top brokerage firms in terms of assets under management. Trade crypto on Binance. OTP expires in: 00:59.

How Safe is the Broker?

Bonuses of up to 100,000 MPH. Some will also offer access to cryptocurrencies, futures trading and foreign currency exchange markets. Central banks do not always achieve their objectives. “Kudos to the team behind this app. So different exchanges’ offerings may vary over time. This also means that there are no overnight holding costs if the position is closed prior to the closing bell. You would like to settle your trade for a profit of ₹1000 for the day. When the shorter term moving average crosses above the longer term moving average, it can signal the start of an https://option-pocket.top/ uptrend, prompting traders to enter a long position. Full fledged grid + pivot + charting all integrated together to give you potentially limitless possibilities when it comes to trading analysis. Additionally, many brokerage firms provide advice regarding most profitable investable securities in the market, acting as a stable investment option for novice investors. An internal hedge is a position that materially or completely offsets the component risk element of a non trading book position or a set of position. You can close or open positions much faster, plus you can speculate on market prices if their rising or falling. More sophisticated models are used to model the volatility smile. These levels can provide valuable insight into potential entry and exit points for your trades throughout the day. With the right app and mindset, you can confidently explore the potential of cryptocurrencies and seize opportunities in this dynamic landscape. Swing trading is a popular approach for all futures market sectors. Follow Feed feature allows users to follow trades of tastytrade’s TV celebrities. Don’t hesitate to tell us about a ticker we should know about, market news or financial education. It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Now, let us have a look at the other best indicator for option trading known as MFI or Money Flow Index. More bars will print in periods of high market activity. Few day traders become profitable right away. ESMA’s guidelines on delayed disclosure of inside information, last updated 20 October 2016. John Paulson, a hedge fund manager in New York, led his firm to make $20 billion in profits between 2007 and early 2009. A graph of daily closing prices of the securities is also available at. The basic formula for the trading account is.

Track Market Movers Instantly

We want to clarify that IG International does not have an official Line account at this time. Conversely, at resistance levels, supply typically exceeds demand, leading to potential price reversals. Then, for the next 30 seconds, demand enters and the price of the stock moves higher to $1. Here are additional advantages. BYDFi is one of the few exchanges that complies with financial industry regulations and holds licenses in Australia, Singapore and the U. Interactive Brokers’ innovative IMPACT app is a great choice for stocks and crypto, and its highly rated IBRK mobile app is excellent for trading forex and CFDs. No tax loss harvesting. Gross Profit/Loss: Gross profit or loss is calculated by subtracting the total product cost from sales revenue. Already have a Full Immersion membership. For example, if you own shares of a company, you could buy put options to mitigate potential losses in the event the stock’s price goes down. Implement those rules into a tradetron algo trading platform. However, these same forces can trigger rapid declines as company fundamentals look poor. You can practice by doing demo trading trading with virtual money or fractional trading trading with small amounts real money. Though they have their advantages, options trading is more complex than trading in regular shares. Traders should be willing to hold onto their positions even during periods of market volatility. Seeking guidance from experienced traders can help shorten the learning curve and improve trading performance. The bonuses are also very high, like 91 Club, 55 Club, Tiranga Game, BDG Win Game, etc. When acquiring our derivative products you have no entitlement, right or obligation to the underlying financial asset. ADNT = Average daily number of transactions. Our platform uses AI driven risk management algorithms to minimize downside risk while maximizing upside potential. List of Partners vendors.

More

YBY is a premium quality sparkling wine, brought to life by Stephan Claus in 2020. A Red Ventures company. Arincen may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers. Trend identification is mostly done through technical analysis, which involves analyzing. There is a practical element to this. That’s the widest range of tradable securities on this list by far, and the most comprehensive access to global markets among our best brokers. All of these strategies can be applied to your future trades to help you identify swing trading opportunities in the markets you’re most interested in. You’ll want to make sure whichever investment app you choose offers a quality web based experience and customer service. Whether you’re playing on a compact smartphone screen or a larger tablet display, the app is engineered to deliver a consistently smooth and responsive gaming experience. CFD Accounts provided by IG International Limited. The mobile stock trading app makes viewing your accounts, positions and balances easy. Very competitive commission and margin rates. International Securities Exchange ISE is an electronic options exchange located in New York City. Experimenting with different indicators can help traders find the best fit for their individual trading styles and goals, leading to more successful and profitable trades. Security is a top priority for Coinbase, and it has implemented various security measures to protect user funds. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Earnings per equity share for continuing operation. If the value of the underlying security moves against the seller of that position, or if there is significant volatility in the underlying security or related markets, the investor might be required to deposit significant additional funds. Let’s understand how scalping works with the help of an example. A popular full service broker charges at least $75 to place a stock trade, and that can jump to as high as $500 or more to buy a large amount of stock. Intrinsic value is measured as the difference between an option’s Strike price and the current price per share of the underlying asset. Investors can seek financial advice from AI managers as well, submitting information on their financial goals and risk tolerance to inform an algorithm’s financial decisions and advice moving forward. Types of chart patterns. Can you really call yourself a trader if you aren’t making money in the markets. Down time 2024 03 20 02. It also offers virtually every type of account you might need, and it has a top rated robo advisor. Add our FX Algo to your trading mix. An option’s price fluctuates based on a number of factors, including how far the strike price is from the underlying security’s current price, as well as the time remaining before expiration. But for all intents and purposes, we’ll stick with these three categories. Brokerage will not exceed SEBI prescribed limit.

Percent move on the day

CFDs are complex instruments. Their support is world class, in my case personally, I needed integration with Trend Spider’s backtesting engine. In conclusion, you’ll be better equipped to navigate the market’s ups and downs by recognizing patterns like bullish reversals or bearish continuations at a glance. To be successful in trading forex, you must learn how to manage risk properly, depending on your goals and the strategy you choose to follow or develop. All digital asset transactions occur on the Paxos Trust Company exchange. It’s also important to regularly review and assess your portfolio to ensure it aligns with your trading goals and risk tolerance. This pattern suggests a potential shift in market sentiment from bearish to bullish. Removal of cookies may affect the operation of certain parts of this website. According to the SEBI, an insider trading conviction can result in a penalty of INR 250,000,000 or three times the profit made out of the deal, whichever is higher. Now options are risky but the correct analysis by choosing the best indicator can help you to an extent to reduce the option trading risk. There are many trading platforms out there, so why should you choose us. PipPenguin makes no guarantees regarding the website’s information accuracy and will not be liable for any trading losses or other losses incurred from using this site. Open Free Demat Account in mins. There are no free lunches in the markets. It offers traders the opportunity to trade various asset classes including forex, stocks, indices, futures, and commodities from the MT4, MT5, cTrader, and the broker’s own proprietary FXPro Edge platform. Additionally, using volume analysis can help confirm the validity of the breakout. ^IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc.

Learning To Trade Via the Share Trading Account

D at 2% on Sundry debtors. How I Made ,000,000 in the Stock Market. Practice day trading stocks anytime now from the comfort of your browser within your TraderSync account. Options exchanges are also closed on holidays when stock exchanges are closed. Here are a few tips to keep yourself safe. Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. Liquidity is the capacity to transact in an asset without impacting its price. Is being able to have the research you need to make that decision. Already have a Self Study or Full Immersion membership. AMP Futures Platforms. For the 3rd case, the price tested below the band and then closed above the middle line, confirming the buy signal. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted to stock trading topics. Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. I enjoyed your article thanks Jean. Both ETFs moved higher throughout the day, but because XLK had such large gains on rallies and slightly smaller declines on pullbacks, it was a market leader and outperformed SPY on a relative basis. A protective put is a strategy that involves buying a put option with a strike price that is usually at or below the current price of a stock that you own and believe might go down in price. Highly illiquid stocks are not ideal for scalping. Discipline is to financial success what salt is to food.